bir form 1905|To be filled up by BIR DLN: 1905 : Manila Unused sales invoices/official receipts and all other unutilized accounting forms (e.g., vouchers, debit/credit memos, delivery receipts, purchase orders, etc.) including business notices and . Mag Pinsan Nag Iyotan - Sarappinay provides the latest pinay sex videos and pinay sex scandals. Watch the latest kantutan videos online here. Home; Categories; Popular; Free Facebook Leaks; Contact; . Viral 6 in 1 Tinuhog pa sa Pwetan. 3:44. Evening ride ni honey. 2:17. Dogstyle. 1:34. OMG Isagad Mo na Arisa! Baka Naman Ohh Pasilip! 11:10 .

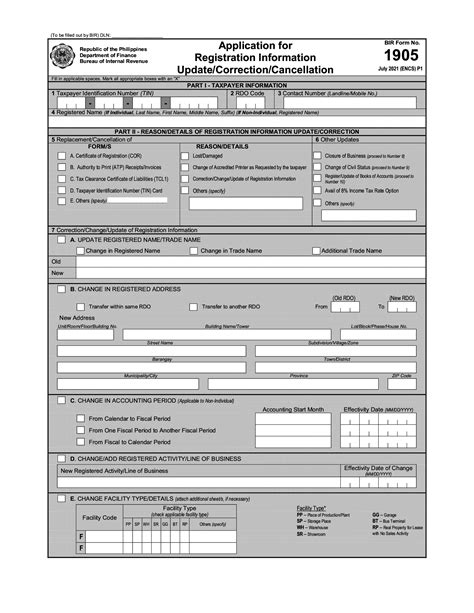

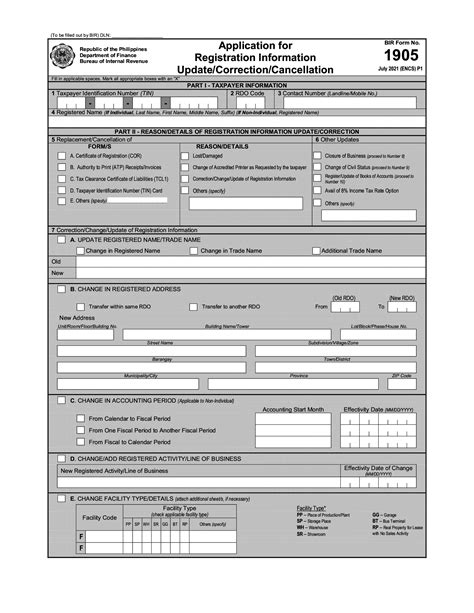

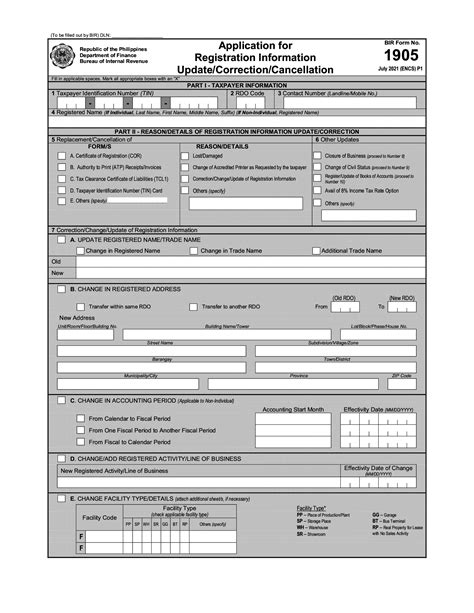

bir form 1905,BIR-Form-1905.pdf - Google Drive . Loading.bir form 1905 To be filled up by BIR DLN: 1905 The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the . Learn what a BIR Form 1905 is, why you need it, and how to fill it out for different purposes. Find out where to download, print, and submit the .BIR Form 1905 is used to request for replacement, cancellation, or update of registration information for taxpayers. It covers various reasons such as change of trade name, address, .Unused sales invoices/official receipts and all other unutilized accounting forms (e.g., vouchers, debit/credit memos, delivery receipts, purchase orders, etc.) including business notices and .BIR Form 1905 is used to apply for changes or cancellations in the registration information of taxpayers. It covers various reasons such as name, address, activity, tax type, incentive, .

Learn how to change your registered address for your Tax Identification Number (TIN) using the BIR Form 1905. Follow the three easy steps and get your TIN transferred to your new RDO in a week.

A video tutorial on how to fill up the BIR 1905 form, which is used to apply for a digital TIN ID. The video also provides links to other videos on how to register for digital TIN ID . The Bureau of Internal Revenue (BIR) Form 1905 is used to register a new taxpayer or update the registration information of an existing taxpayer. This includes changes like business, registered address, contact .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .

APPLICATION FOR CHANGE IN REGISTERED ADDRESS What this is For: BIR Form 1905 BIR Form 1905 Application for Registration Information Update. Where to File: Computerized RDOs (Within same RDC) Taxpayer submits form 1905 to new RDO.bir form 1905 Prior to the issuance of RMO No. 37-2019, employees who recently changed employers update their BIR registration records through their new employer by filing a Certificate of Update of Exemption and of Employer’s and Employee’s Information (BIR Form 2305). In BIR Form 2305, both the employee’s residential address and the employer’s .

BIR Form No. 1905 – page 3 10 Books of Accounts Type (Manual or Loose) From Type of Books to be Registered Quantity Volume To Date Registered (MM/DD/YYYY) Permit Number Date Issued (MM/DD/YYYY) 11 Other Update/Correction . The BIR Form 1905 is the form that taxpayers use to request the BIR to update, correct, or change their registration information, including any of the following: Registered address (transfer within the same RDO or to another RDO) Registered name/trade name;

1905 Application for Registration Information Update for Updating / Cancellation of Registration / Cancellation of TIN / New Copy of TIN card / New copy of Certificate of Registration Application Forms - This BIR form is to be accomplished by all taxpayers who intend to update/change any data or information, e.g. transfer of business within the same RDO, .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, . Step 2: Download and fill up BIR form 1905 The next step would be to download the BIR form 1905 online. You may find this form on the BIR website. The form will require: Part 1: Fill up – TIN Number – RDO Code – Contact Number – Registered Name Part 2: – Locate section 7 – Tick Field 7 B or “Change Registered Address”

bir form no. 1905 (encs) - page 2 4f change in registered old line of business new line of business activities effective date of change 4g change in registered name/ trade name registered name trade name new old 4h change in tax cancelled tax type(s) added (new) tax type(s) atc (to be filled up by bir) (to be filled up by bir) effective date

BIR-Form-1905.pdf - Google Drive . Loading.

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .To be filled up by BIR DLN: 1905 Bir Form 1905 2000-2024. Fill out, securely sign, print, or email your Bir Form 1905 2000-2024 instantly with airSlate SignNow. Start a free trial now to save time and money!File a duly accomplished BIR Form 1905 (Application for Registration Update) in 2 original copies where your TIN is currently registered. Indicate the new RDO where you are requesting to be transferred. Bring the BIR Form 1905 to your old RDO. In about a week, the process should be done and your TIN should now be registered to your new RDO. To streamline this process, the Bureau of Internal Revenue (BIR) rolled out a new mandate for form 2305, or the Certificate of Update of Exemption and of Employer’s and Employee’s Information. Here are the official purposes of form 2305 and a similar form, form 1905. Form 1905 Form 1905 is used to update your Revenue District Office (RDO . Two copies of BIR Form 1902, accomplished by both the employee and employer (or employer’s authorized representative such as an HR officer) For local employees: Birth certificate, community tax certificate, or any valid ID (such as passport and driver’s license) indicating the applicant’s name, birth date, and address; For married local employees: .

BIR Form No. 1604-E January 2018 (ENCS) Page 1: Annual Information Return . If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) 7A ZipCode: 8 Category of Withholding Agent Private: Government: 8A If private, top . LINK TO BIR FORM 1905: https://www.bir.gov.ph/images/bir_files/taxpayers_service_programs_and_monitoring_1/1905%20Jul%202021%LATEST VERSION 2021

The BIR Form 1904 is a tax form that one-time taxpayers and people registering under EO 98 use to apply for a TIN before paying any tax due, filing a tax return, or receiving a TIN. Who Should File BIR Form 1904? Applicants under EO 98 (e.g., unemployed Filipinos, OFWs, etc.) applying for a TIN to transact with any government office .

bir form 1905|To be filled up by BIR DLN: 1905

PH0 · To be filled up by BIR DLN: 1905

PH1 · How to Transfer Your RDO Using BIR Form 1905

PH2 · How to Fill Out BIR Form 1905 to Change or Update Your Taxpayer

PH3 · How to Fill Out BIR Form 1905 to Change or Update Your

PH4 · How To Easily Transfer Your Rdo Using Bir Form

PH5 · HOW TO FILL UP THE BIR 1905 FORM

PH6 · Bureau of Internal Revenue

PH7 · BIR Form No. Republic of the Philippines Department of Finance

PH8 · BIR Form 1905: how to fill up in 2023? Sample, latest version

PH9 · BIR Form 1905: how to fill up in 2023? Sample, latest

PH10 · BIR

PH11 · 1905